Bookkeeping

How to Calculate Retained Earnings on a Balance Sheet Chron com

Content

One influential factor is the maturity of the company, as a low-growth company with minimal opportunities for capital allocation is more likely to issue dividends to shareholders. In other words, cash from operations is sufficient to fund reinvestment needs. On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders. This, of course, depends on whether the company has been pursuing profitable growth opportunities. The retained earnings are calculated by adding net income to the previous term’s retained earnings and then subtracting any net dividend paid to the shareholders.

Is Stadler Rail AG’s (VTX:SRAIL) 16% ROE Strong Compared To Its Industry? – Simply Wall St

Is Stadler Rail AG’s (VTX:SRAIL) 16% ROE Strong Compared To Its Industry?.

Posted: Wed, 28 Sep 2022 04:57:46 GMT [source]

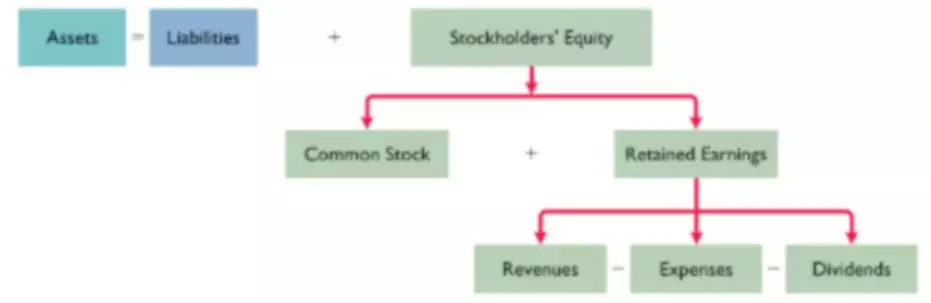

However, to be able to make a decision in which both the investor and the company are guaranteed of a win, the retained earnings past performance will be used to assess the trend. Thereafter, can they then decide whether to go for the dividends payout or opt for reinvestment for long term value. Retained earnings are a type of equity, and are therefore reported in the Shareholders’ Equity section of the balance sheet. Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future, or to offer increased dividend payments to its shareholders.

Step 2: State the Balance From the Prior Year

Management will regularly review retained earnings and make a decision based on the goals and objectives they have established. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. I have no business relationship with any company whose stock is mentioned in this article. Net Earnings are reported in the Income Statement, and Cash Dividends are reported in the “Cash Flows from Financing Activities” section of the Statement of Cash Flows.

If your business currently pays shareholder dividends, you simply need to subtract them from your net income. A high percentage of equity as retained earnings can mean a number of things.

How to Interpret Retained Earnings

Your retained earnings account is $0 because you have no prior period earnings to retain. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own retained earnings formula business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Your retained earnings account on January 1, 2020 will read $0, because you have no earnings to retain.

- From there, you simply aim to improve retained earnings from period-to-period.

- In this case, because there is a net loss, the figure is subtracted from retained earnings rather than added.

- Since in our example, December 2019 is the current year for which retained earnings need to be calculated, December 2018 would be the previous year.

- In addition to this, many administering authorities treat dividend income as tax-free, hence many investors prefer dividends over capital/stock gains as such gains are taxable.

The Retained Earnings account can be negative due to large, cumulative net losses. The RE balance may not always be a positive number, as it may reflect that the current period’s net loss is greater than that of the RE beginning balance. Alternatively, a large distribution of dividends that exceed the retained earnings balance can cause it to go negative.

How Do You Prepare Retained Earnings Statement?

A retained earnings statement is important because it can provide insights into the profitability of a company as well as the dividend payout policy. https://www.bookstime.com/ It also can serve a legal purpose in that treasury stock purchases are often limited by law based upon the amount of retained earnings for a year.